Rapidly changing economic condition, new evolutions in the competitive landscape, increasing regulatory oversight, rising customer expectations, shareholder expectations on returns, top-line growth & transparency – these are some of the imperatives that the banking industry is currently experiencing. Banks therefore, seek to respond to these exacting expectations by re-orienting their people, process and technology.

Towards this, we, at ANB, bring you our comprehensive Banking Services. Our services help banks expand their customer base, offer better services and enhanced customer experience. We also help you reduce costs through Business process simplification and business process re-engineering.

overview

As the banking environment becomes more demanding, mergers and acquisitions with smaller banks or niche players become a means to drive market share and offer comprehensive packaged products and services. Today’s business environment is largely influenced by lower growth and margins, excessive volatility and increasing regulations. Given these business pressures, banks need to focus on developing new products with value-added features and organize the infrastructure-spend to accommodate modern technology.

With our expertise in financial services consulting, technology and outsourcing, we have partnered with numerous large Financial Institutions to offer effective solutions. Understanding the banking and financial services industry’s competitiveness and complexities, we leverage our presence in the industry to bring you appropriate solutions that cater to your needs. Our robust solutions are designed to address challenges of developing new business models and defining new business architecture. In addition, we optimize your IT, rationalize technology, modify systems, and automate processes.

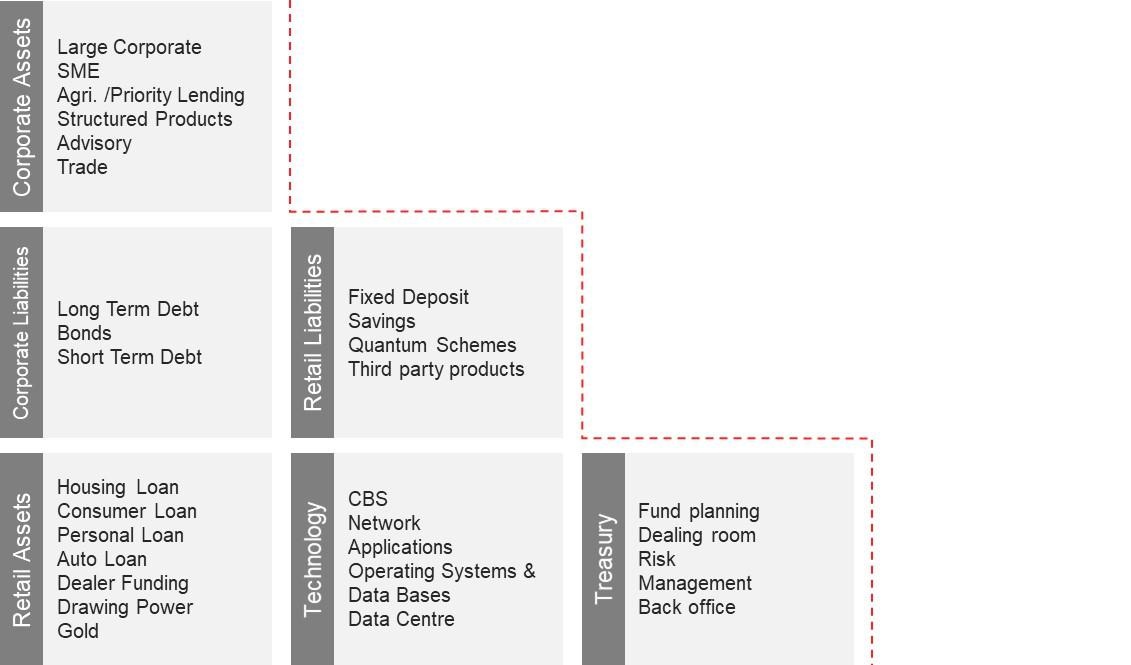

we service the complete banking segments

Our Unique Value Adds

Enterprise Risk Management Process

Control Design Reviews Internal Audit

Business Process Design & Documentation

Business process Reviews

Quality Assurance Framework

Cost Optimizations Reviews

Cost Optimizations Reviews

Business & Strategy Advisory

Customer handling

Revenue Assurance

Network Reviews Market, Customer Acquisitions Regulatory

Compliances

how we can help you

- Develop risk management strategies

- Alignment of risks with organization mission & vision

- Risk organization & governance

- Risk culture & performance transformation

- Planning and executing a fraud risk management program

- Perform an anti-fraud control gap analysis

- Developing approach of Diagnose, Detect and Respond Strategy

- Improving organizational objectives

- Diagnostic review and reworking of current business strategy

- Identifying key success factors for business

- Developing strategy & implementation plan

- Enhancing revenue and cost reduction

- Evaluate business implications of emerging trends

- Encourage increased utilization of data and analytics

- Improving efficiency in operations

- Increasing financial reliability and integrity

- Ensuring compliance with laws and statutory regulations

- Establishing monitoring procedures

- Greater shareholder confidence through a superior financial reporting process

- Strengthening the Control Environment

- Control concepts becoming embedded into the organization

strong banking team with expertise across banking processes

ANB’s workforce comprises of 450+ professionals with a dedicated team of 95+ resources servicing the banking vertical. Our leadership team assumes overall responsibility for engagement delivery for all banking assignments and is strongly supported by a team of subject matter experts specializing in specific functional domains. We will deploy a three layered supervisory team to ensure industry benchmarking, domain specialization and operational excellence in execution of each engagement.

Overall team strength of 450+ with 150+ CA’s/ MBAs and Engineers with experience in various industries.

Ability to provide various language speaking resources with industry knowledge and audit skills

450+ Resources

Our Opening Hours Mon. - Fri.

100+ Banking Experts

Our Opening Hours Mon. - Fri.

CA’s/ MBAs/ IT/ Engineers

Our Opening Hours Mon. - Fri.

100 + Banking experts having experience in Customer Service, Sales & Distribution & Marketing. Network, Revenue Assurance areas

Resource presence in Middle East, India, Africa, APAC and other countries through network firms

case studies

compliance review

Read More

foreign exchange compliance review

Read More

data governance

Read More

quality assurance review

Read More

outsourcing of activities by Banks

centralized monitoring

Read More