overview

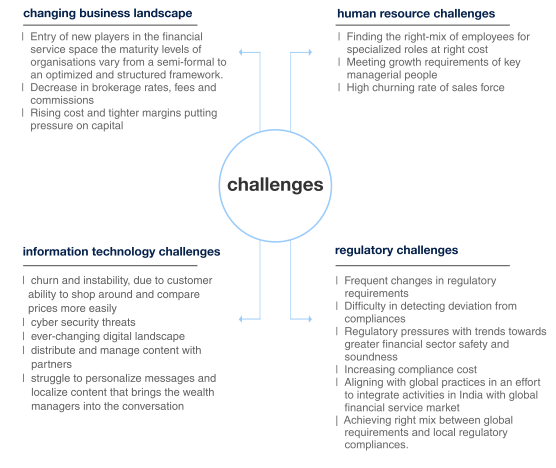

Financial Services sector is undergoing rapid expansion and is poised to grow exponentially on the background of demand from growing individual incomes, adoption of technology to achieve greater financial inclusion & regulator’s prerogative to protect customer’s interest. This calls for ensuring a balance is achieved to meet regulator’s expectations as well as ever-growing needs of a technology advanced customers.

ANB with its strong team of experts caters to the entire spectrum of financial service which meets the business & regulatory needs of our clients.

we service the complete financial service ecosystem

Exchanges & Depositories

Portfolio Management Service

Brokers

Investment Advisory

Depository Participants

Research Analyst

Mutual Funds

NBFC

how we can help you

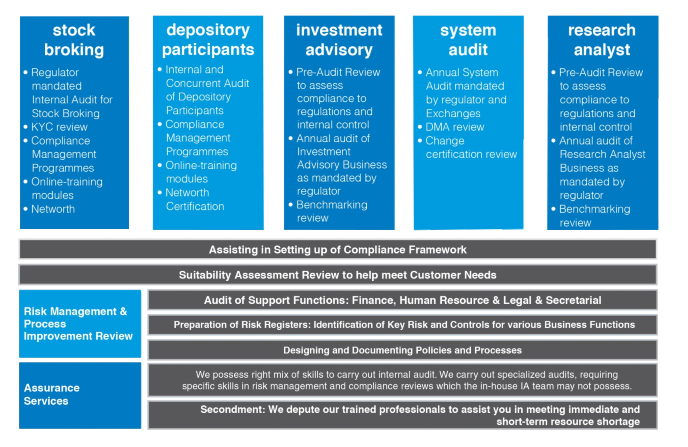

Internal Audit

- Improving efficiency in operations

- Increasing financial reliability and integrity

- Ensuring compliance with laws and statutory regulations

- Establishing monitoring procedures

Technology Upgrade

- Information governance

- Information Risk Management

- Streamlining systems

- Business process reengineering

- Functional control reviews

Business Process Review

- Enhancing revenue and cost reduction

- Evaluate business implications of emerging trends

- Encourage increased utilization of data and analytics

Secondment of Resources

- Trained professionals with industry expertise

- Technology / Business projects implementation

our solutions and expertise

- We invest in thought leadership and industry debates to keep our clients at the forefront of advanced thinking and practical solutions.

- Our ANB participation in well regarded industry conferences, provide opportunity to discuss the most pressing issues with senior industry leaders, regulators and governments.

- Dedicated team with strong legal and technology expertiseRepository of applicable regulations and circulars for financial service industry

450+ Resources

Our Opening Hours Mon. - Fri.

100+ Financial Experts

CA’s/ MBAs/ IT/ Engineers

Our Opening Hours Mon. - Fri.

case studies

building up compliance repository

ANB has helped a leading financial house set up compliance repository to help identify potential regulatory requirements.

Read More

Read More

compliance to securities exchange board research analyst regulations

ANB has helped a leading financial house to review its existing business structure and suggest measures to meet requirements

Read More

Read More

wealth business for an institutional stock broker

ANB has helped a financial service provider expand its business outreach and expand its client offerings from being a purely sales and execution house to becoming a wealth manager catering to High Net worth clients.

Read More

Read More

sop design and documentation

ANB has helped a leading private bank ride on the ‘digital-wave’ by helping design and document processes for its digital expansion.

Read More

Read More